Source: https://financialpost.com/executive/executive-summary/posthaste-deeper-correction-possible-as-rate-hike-takes-a-hammer-to-housing-says-bmo

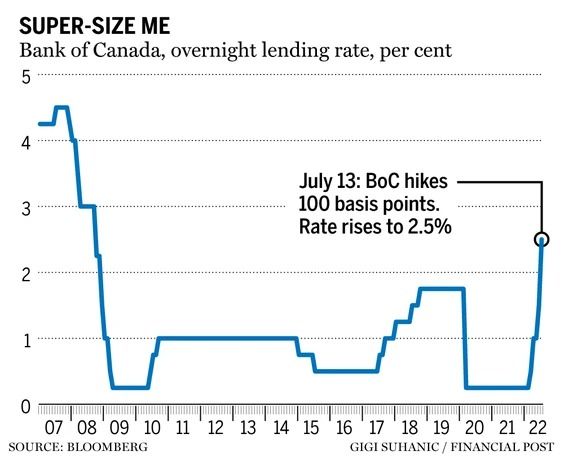

The Bank of Canada’s 100-basis-point hike was like taking a “hammer” to the housing market, setting it up for an even deeper correction next year, says a BMO senior economist.

“The fact that the market had already cracked after the BoC’s initial move in rates only reinforced how sentiment-driven the market was, and how quickly that can change,” BMO’s Robert Kavcic said in a recent note.

The abrupt shift in sentiment was apparent even before the Bank’s supersized hike on July 13 with a survey done the week before revealing that more Canadians now expect lower home prices ahead rather than higher, said Kavcic.

The Nanos survey found that just 30% now expect higher prices, down from almost 70% at the height of the pandemic housing boom.

“We’ve argued all along that there was a major behavioural aspect to what was happening in Canadian housing, where acute price gains were driven by FOMO, speculation and investment activity,” wrote Kavcic. “Indeed, the proof is that even just an initial nudge in interest rates was enough to crack expectations and trigger a correction. The latest move by the Bank of Canada will wash away any remaining froth.”

Borrowing costs have gone from 1.5% at the start of the year to about 4.5% in a matter of six months which is a “massive pill for the market to swallow,” said Kavcic.

Qualifying rates are also rising. The stress test, the higher of 5.25% or 200 bps above the contract rate, has now risen to 6% for variable rate mortgages and 7% for fixed.

“So, unlike previous rounds of tightening, this move now also begins to carve into purchasing power on paper,” he said.

The swift rise in interest rates and weakening economic outlook has prompted other economists to downgrade their forecasts for Canada’s housing market.

Oxford Economics — already on the bearish end of the spectrum with their earlier forecast of a 24% home price correction — now see a larger 27% peak-to-trough drop in prices by the first quarter of 2024.

Sadly, falling prices are not expected to make Canadian housing more affordable any time soon. The reading on Oxford’s home affordability index in the first quarter of this year showed the typical home price was 51% above the borrowing capacity of median-income households — a record for the index that dates back to 2005.

“Now rising interest rates are creating a new headwind for households, driving affordability further into unprecedented territory,” said Oxford.

It expects the home price to rise to 72% above the median borrowing capacity by the third quarter as higher mortgage rates offset lower home prices.

The good news is that affordability should start to improve as mortgage rates peak late in the year, Oxford said.